The latest MLS release with December/Full-Year 2022 residential sales statistics has been posted in the HAR Newsroom. From this release, we learned that-- despite strong sales throughout the pandemic-- Houston’s seven-year run of record-breaking home sales was finally interrupted in 2022 by rising mortgage rates, inflation and lack of affordable inventory. While the inventory situation was extremely challenging, it was mortgage rates that had the most impact-- rising throughout much of the year as the Federal Reserve tried interest rate hikes to combat inflation. These increases cause many potential homebuyers to postpone their plans, causing the rental market to thrive. While rates have decreased steadily after peaking above seven percent in November, sales are still slow and not likely to rebound until at least Spring.

Sales of single-family homes were down almost 11 percent compared to 2021, but record prices in the $400,000s kept 2022’s total dollar volume close to 2021’s record level.

According to HAR’s December/Full-Year 2022 Housing Market Update, single-family home sales declined 10.9 percent to 95,113. Sales of all property types were down 10.7 percent from 2021, while total dollar volume dropped just 1.5 percent to $39.3 billion versus $40 billion in 2021.

“While disappointing, it was no surprise that 2022 ended the way it did given the economic forces that affected the market during the latter half of the year, most notably inflation, mortgage rates and persistently low inventory,” said HAR Chair Cathy Treviño.

“We have been in uncharted territory since the pandemic, but have generally held strong, and I anticipate the market returning to healthier levels later this year, especially with inventory levels improving, mortgage rates easing and prices moderating.”

For the month of December, single-family home sales fell 32.6 percent-- the ninth straight monthly decline of 2022 and the steepest. Sales volume went down in all segments of the market, with the biggest drop, 42.8 percent, among homes priced between $150,000 and $250,000-- followed by the $1M and above segment, which saw a 34.8 percent year-over-year decline.

The median price of a single-family home – the point at which half of the homes sold for more and half sold for less – was $330,000 in December. This marked the third straight month it held at that level-- 3.8 percent higher than last December. The average price of $409,777 increased 5.1 percent compared to last year.

2022 Annual Market Comparison

Houston began 2022 with strong momentum coming off the second year of the pandemic in record territory. However, conditions changed when the average price reached a record high of $438,301 in May and the median price jumped an all-time high of $353,995 in June. Between that and the persistent lack of inventory, many found themselves squeezed out of the market. Monthly sales volume slackened, falling in April and every month thereafter. In the end, this made 2022 the first year of declining sales since 2015.

One positive was that an uptick in new listings eventually provided a boost to inventory levels, pushing it past the two months of supply for the first time in two years. Inventory had reached 2.0-months supply in June and by December was at a 2.7-months supply. Houston’s highest inventory was 2.8 months in October and November.

June had the strongest sales volume of the year with 9,844 single-family units sold.

By the end of December, 95,113 single-family homes had sold across greater Houston in 2022-- a 10.9 percent decline from the 106,756 homes sold in 2021.

On a year-to-date basis, the average price increased 10.0 percent to $413,657 while the median price rose 12.8 percent to $338,295. Total dollar volume for 2022 dropped 1.5 percent to $39.3 billion.

Houston’s lease market had a generally strong 2022 as prospective buyers leased homes to rent until they are prepared to resume the buying process. HAR will report on those trends in the December 2022 Rental Home Update, due out Wednesday, January 18.

December Monthly Market Comparison

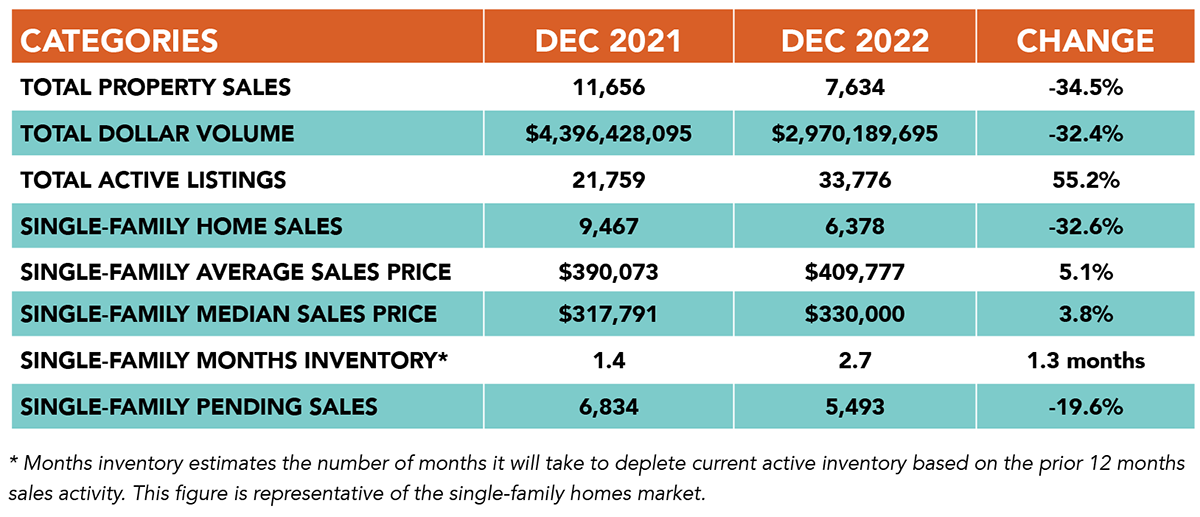

Houston’s housing market showed mixed results in December, as single-family home sales, total property sales and total dollar volume fell compared to December 2021-- while pricing rose. Month-end pending sales for single-family homes totaled 5,493, a decrease of 19.6 percent versus one year earlier. Total active listings surged 55.2 percent from a year earlier to 33,776.

Over the year, single-family homes inventory grew from a 1.4-months supply to 2.7 months. For perspective, national housing inventory currently stands at a 3.3-months supply, according to the latest National Association of Realtors (NAR) report.

December Single-Family Homes Update

Single-family home sales totaled 6,378, a drop of 32.6 percent from December 2021-- marking the ninth consecutive negative sales month of 2022 as well as the steepest decline. The median price went up 3.8 percent to $330,000. The average price rose 5.1 percent to $409,777. Pricing gains significantly slowed during the fourth quarter of 2022 compared to the double-digit jumps that prevailed during the first six months of the year. Days on Market (DOM), or the number of days it took the average home to sell, increased from 38 to 57.

Broken out by housing segment, December sales performed as follows:

- $1 - $99,999: decreased 22.3 percent

- $100,000 - $149,999: decreased 29.1 percent

- $150,000 - $249,999: decreased 42.8 percent

- $250,000 - $499,999: decreased 29.7 percent

- $500,000 - $999,999: decreased 19.6 percent

- $1M and above: decreased 34.8 percent

HAR also breaks out the sales figures for existing single-family homes, as opposed to new construction. Existing home sales totaled 4,235 in December-- down 42.4 percent versus the same month last year. The average sales price for an existing single-family home increased 3.8 percent to $402,556 while the median sales price was flat at $310,000.

Townhouse/Condominium Update

In June, townhome and condominium sales experienced their first decline, and this trend continued throughout the rest of 2022. December volume dropped 46.1 percent with 438 units sold versus 812 a year earlier. The average price decreased 6.6 percent to $241,502 while the median price went down 2.3 percent to $214,999. Inventory increased from a 1.7-months supply to 2.0 months.

HAR’s Real Estate Highlights for December and Full-Year 2022

- 2022 marked the first year of declining home sales for the Houston market since 2015, with 95,113 single-family homes sold versus 106,756 in 2021 – a decline of 10.9 percent

- Total dollar volume for full-year 2022 fell just 1.5 percent to $39.3 billion

- December single-family home sales fell 32.6 percent year-over-year with 6,378 units sold

- Total December property sales dropped 34.5 percent to 7,634 units

- Total dollar volume for December fell 32.4 percent to $2.9 billion

- At $330,000, the single-family home median price rose 3.8 percent

- The single-family home average price climbed 5.1 percent to $409,777

- Single-family homes months of inventory expanded 2.7-months supply

- Townhome/condominium sales spent the latter half of 2022 with declining sales, and in December, volume fell 46.1 percent with the average price down 6.6 percent to $241,502 and the median price down 2.3 percent to $214,999

- Townhome/condominium inventory grew from a 1.7-months supply to 2.0 months