Single women in the United States own more homes than their male counterparts, despite typically earning less money than men do, according to a recent analysis by LendingTree of 2021 Census data. Single women own approximately 10.7 million homes, compared to 8.1 million for single men. This means that single women own an average of 12.9% of the owner-occupied homes in the 50 states, versus 10.06% among single men.

To be clear, a vast majority of owner-occupied homes in the U.S. belong to couples. Women dominate ownership in what's left over, particularly in states like Alabama, Louisiana, and South Carolina, where home prices are cheaper, making it easier for a single income to handle mortgage payments.

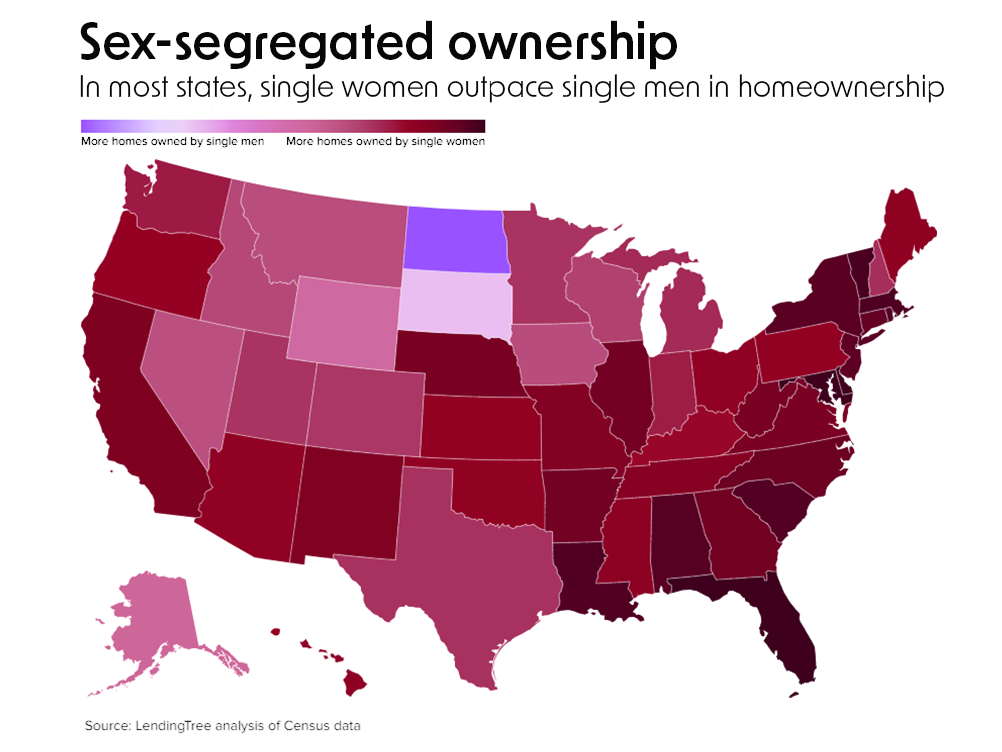

Delaware, Florida, and Maryland have the widest gender gap among single homeowners, with single women owning 262,000 more homes than men in Florida. Single men out-own homes only in North and South Dakota, states where the job market skews toward male-dominated professions such as oil rigging and construction. Louisiana has the highest share of homes owned by single women, with 15.16% of Louisiana owner-occupied households being owned by single women, more than two percentage points higher than the 50-state average. Wyoming has the smallest gap in homeownership rates among single women and men, with a homeownership gender gap of only 0.39%.

Research has shown that women face financial and societal setbacks in America, including being skipped over for promotions, not being taken seriously at work, and being forced out of the workforce. On average, women earn 83 cents for every dollar a man makes, and this gap exists in nearly every state in the U.S.

Even though women generally earn less money than men, the gender gap script is flipped when it comes to homeownership. There are a few possible explanations. For example, there is evidence that suggests single women prioritize homeownership more than single men. There is also evidence that single women are more willing than single men to make sacrifices to become homeowners. Finally, studies consistently show that more women today are college-educated than men, which gives more of them the opportunity to buy a home on their own, since college degrees translate to earning more money later in life.

This could help explain why single women own a greater proportion of homes than single men, even if they are often less financially well off.

The reasons for women's unequal homeownership vary by age group. Among older women, longer life expectancies are a factor, as women are expected to live until age 81 on average, compared to 76 for men.

On the other hand, younger women are approaching the peak of their careers and earn salaries almost equal to men their age. Younger women are well aware of the wage and wealth gap that persists between genders, and buying a home is one way they try to counter it. "They make an effort to try and keep up," said University of Southern California professor Dowell Myers, who studies how demographics affect housing. "Homebuying is a good investment and it means more to them personally than men."

However, the trend of single women owning more homes than single men may have long-term financial implications for single Americans. Homeownership is often one of the most effective methods of building personal wealth. A typical homeowner who bought their home in 2011 accumulated $225,000 in housing wealth by 2021 on average, according to an analysis from the National Association of Realtors in 2022. Even if the gender wag gap persists, the gender wealth gap could change quite quickly, due to real estates higher return on investment, compared to other wealth-building vehicles.