As the Houston housing market moves towards returning to its pre-pandemic state, there are positive signs emerging. Although February sales decreased compared to the previous year, they improved compared to February 2019, which was the last pre-pandemic February. Additionally, pricing decreased year-over-year for the first time in over two years, and more homes were listed for sale. These developments are indicative of what potential homebuyers had been expecting after refraining from entering the market last year due to the increase in mortgage interest rates.

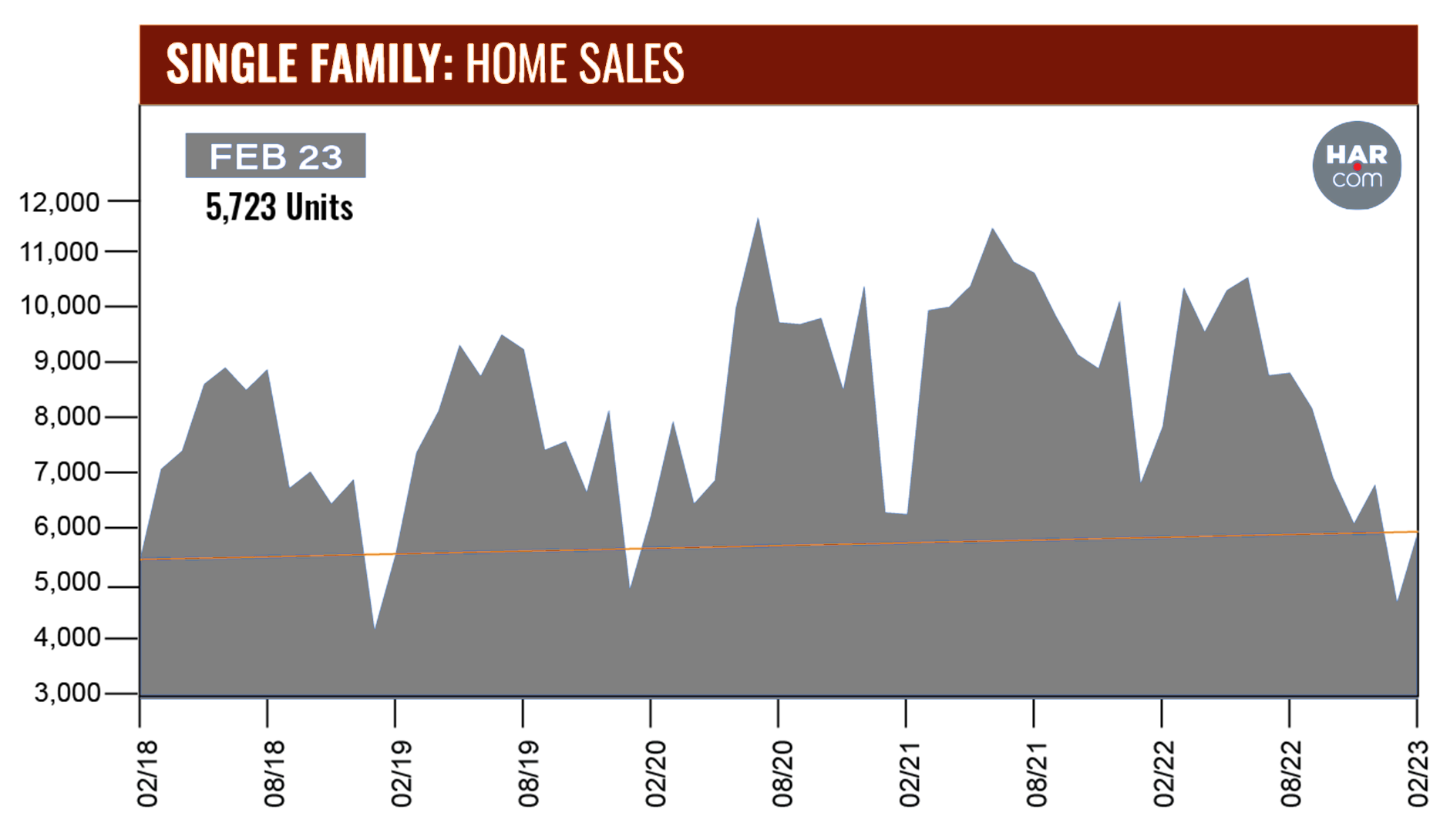

The Houston Association of Realtors' (HAR) February 2023Market Update reveals a 23% drop in single-family home sales, with 5,723 units sold compared to 7,430 in February 2022, marking the 11th consecutive monthly decline. However, sales were up by 7.2% when compared to February 2019, the last February before the pandemic, with sales volume of 5,339 units. All housing segments saw year-over-year declines in February, but single-family and townhome/condominium rentals had solid gains, with buyers shifting to the rental market until mortgage rates and inflation ease. HAR's February 2023 Rental Home Update, to be released next Wednesday, March 15, will provide the latest report on rental trends.

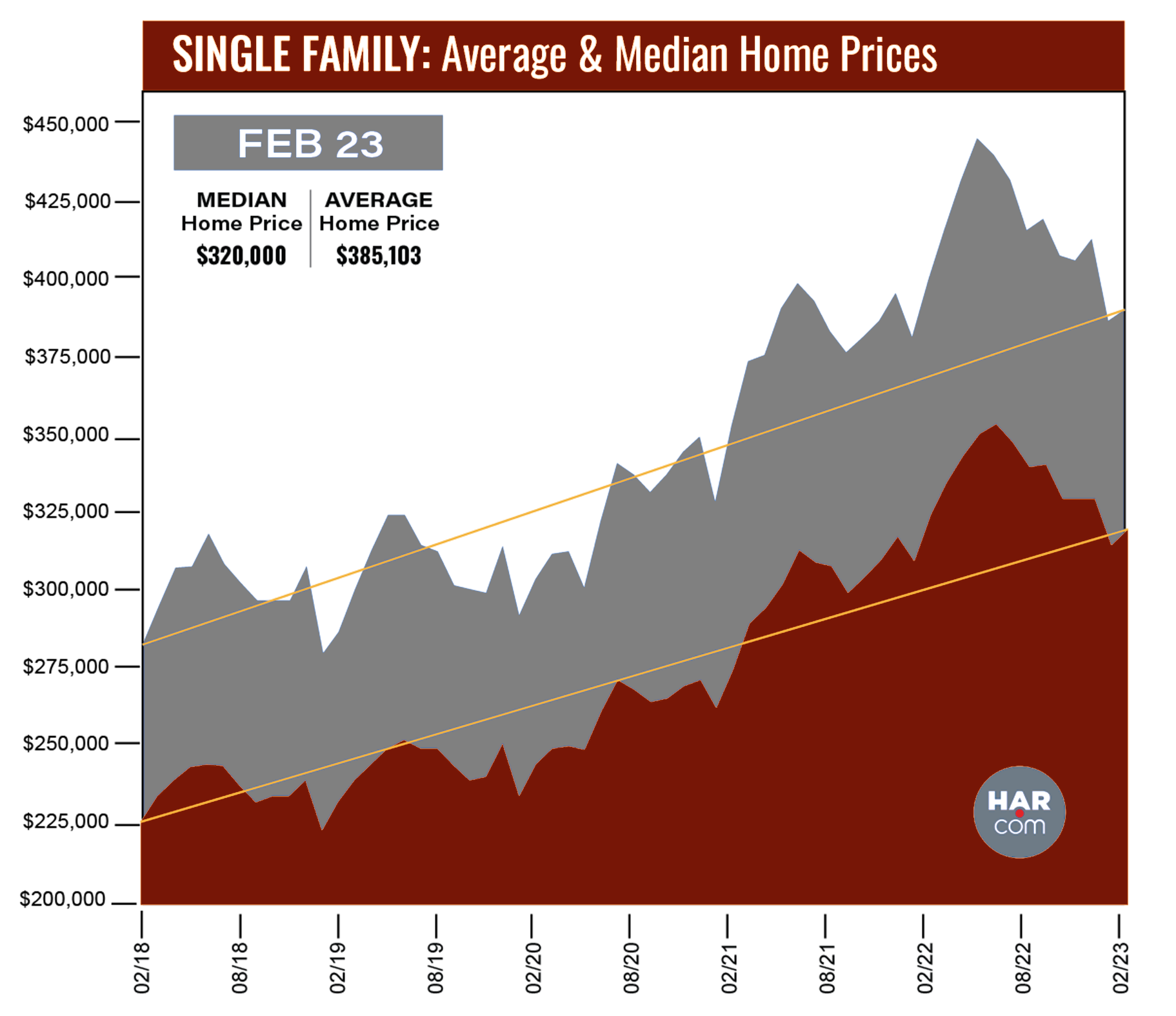

HAR Chair Cathy Treviño explained that examining the Houston housing market before the pandemic shows similar territory, with positive trends such as moderating prices and growing inventory that bode well for spring homebuying. Single-family home prices dropped for the first time since the spring of 2020, with the average price declining by 2.4% to $385,103, and the median price dropping by 1.6% to $320,000. This is a significant contrast to when prices reached record highs in May and June 2022.

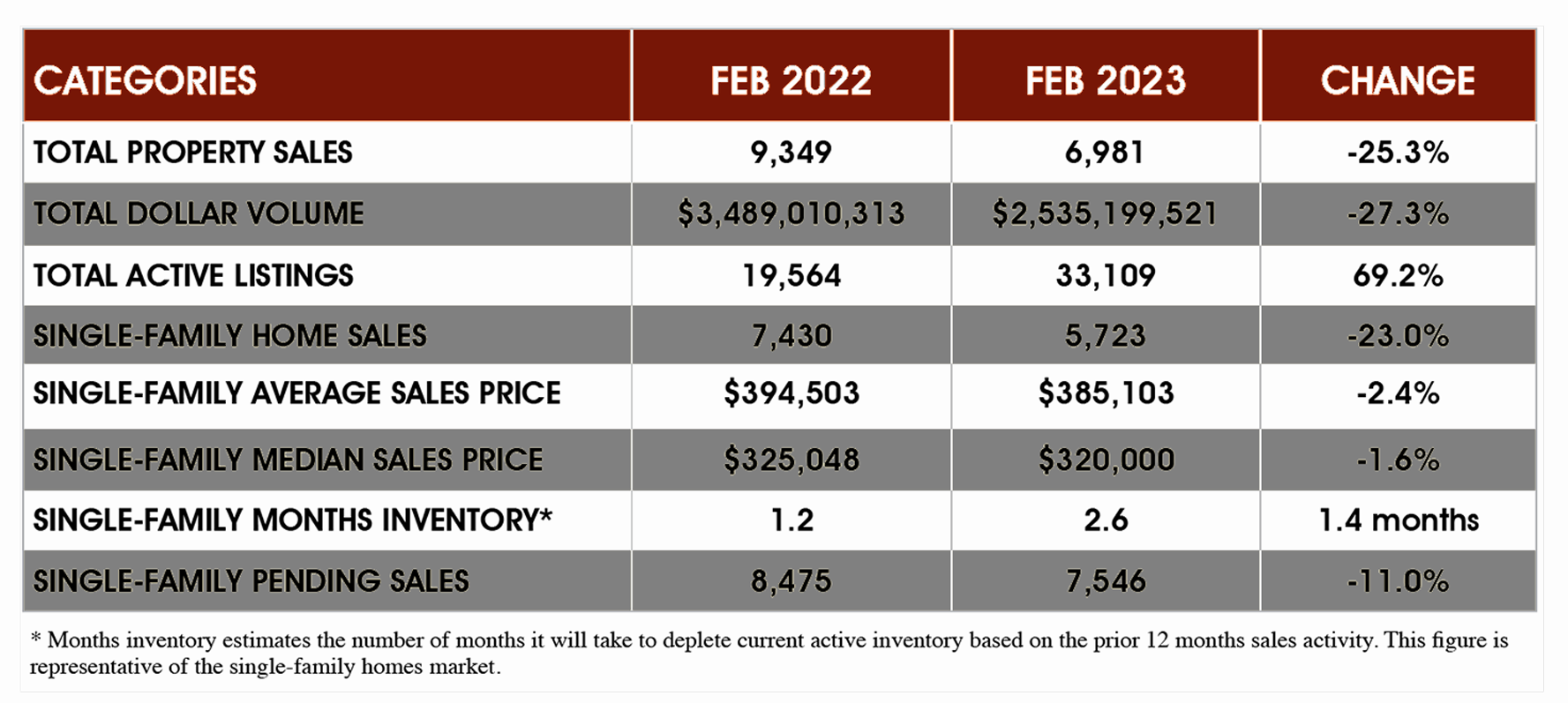

The February monthly housing measurements reveal predominantly negative readings, with total property sales and total dollar volume experiencing a decline alongside single-family home sales. Additionally, single-family pending sales dropped by 11%. However, active listings remained at a level 69.2% higher than the previous year. The months of inventory continued to improve, with a 2.6-month supply in February, compared to a 2.9-month supply for housing inventory nationally, as reported by the National Association of Realtors (NAR). A 4.0- to 6.0-month supply is typically considered a "balanced market" where neither the buyer nor the seller has an advantage.

Single-Family Homes Update

Single-family home sales across the Greater Houston area

experienced a 23.0% year-over-year decrease in February, with 5,723 units sold

in comparison to 7,430 units sold in 2022. After reaching record highs last

spring, pricing continues to level off, with February's median price dropping

by 1.6% to $320,000 and the average price decreasing by 2.4% to $385,103. These

are the first pricing declines since the spring of 2020. However, when compared

to pre-pandemic times, February sales have increased by 7.2% compared to

February 2019 when 5,339 single-family homes sold, with a median price of

$233,000 (37.3% lower) and an average price of $284,864 (35.2% lower).

Additionally, sales are up 8.7% from five years ago in February 2018, when the

total volume was 5,265, with a median price of $226,400 and an average price of

$280,894 – indicating price increases of 41.3% and 37.1%, respectively.

The amount of time it took to sell a home, also known as "Days on Market," increased from 42 to 63 days. The months supply, which is the amount of time it would take to sell all available properties at the current pace of sales, was 2.6 months in February, compared to 1.2 months during the same period last year. The national supply of homes currently stands at 2.9 months, as reported by the National Association of Realtors (NAR).

Broken out by housing segment, February sales performed as follows:

- $1 - $99,999: decreased 2.2 percent

- $100,000 - $149,999: decreased 27.0 percent

- $150,000 - $249,999: decreased 17.2 percent

- $250,000 - $499,999: decreased 23.4 percent

- $500,000 - $999,999: decreased 23.3 percent

- $1M and above: decreased 33.3 percent

The Houston Association of Realtors (HAR) provides separate data for existing single-family homes, which totaled 3,939 in February, representing a 31.0 percent decline from the same month in the previous year. The average price for existing homes decreased by 2.1 percent to $382,366, and the median sales price dropped by 3.9 percent to $306,415.

Townhouse/Condominium Update

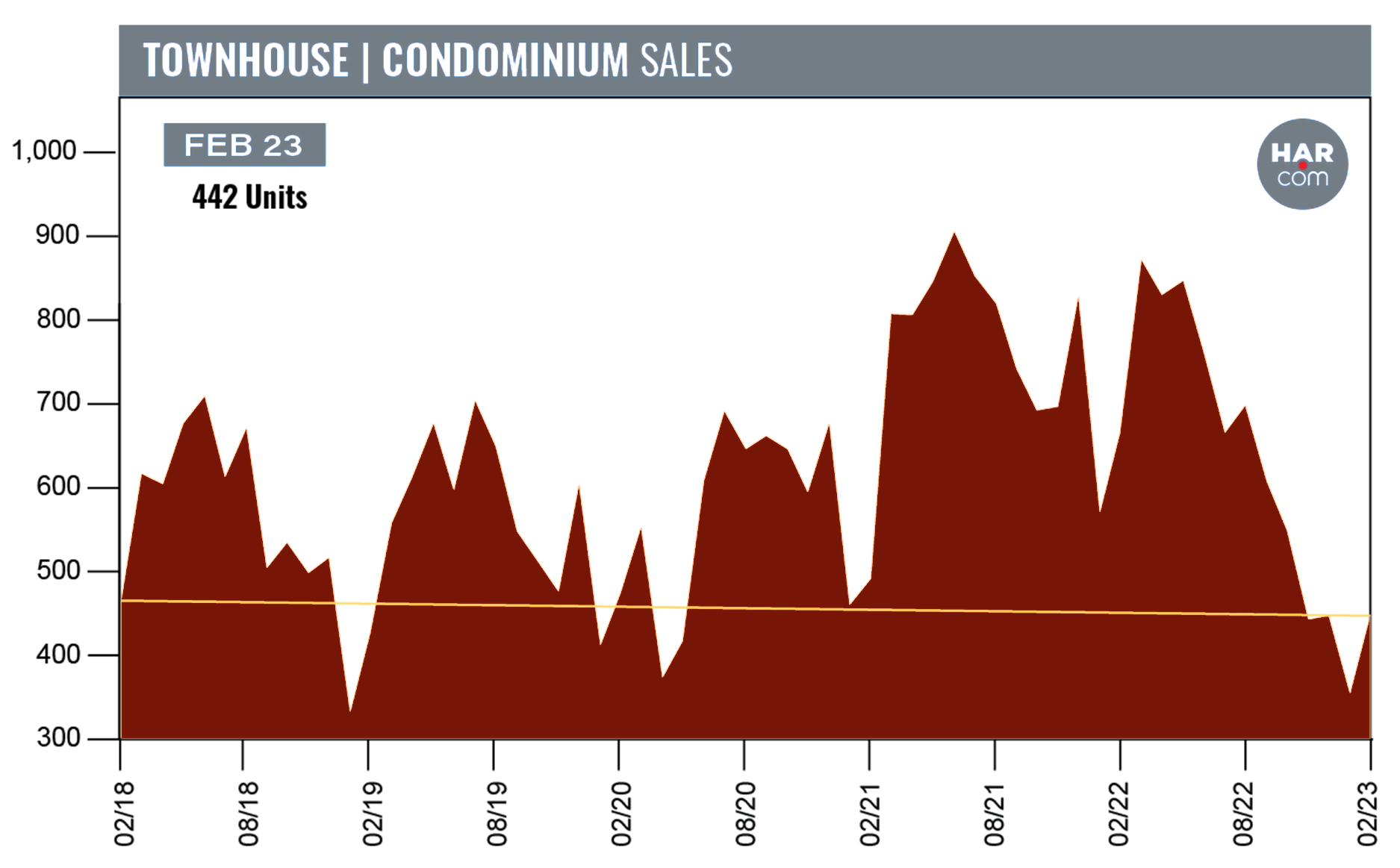

In February, the sales of townhouses and condominiums

showed a year-over-year decrease of 32.4 percent, with 442 units sold compared

to 654 in the same month last year. The average price also decreased by 7.8

percent to $244,595, marking the fourth consecutive month of decline.

Similarly, the median price fell 3.8 percent to $216,510, both below the record

highs seen in April 2022. The inventory increased from a 1.3-months supply to

2.1 months

In comparison to February 2019 before the pandemic, when 423 units were sold, the sales of townhomes and condominiums increased by 4.5 percent. The median price was $151,500, which is 42.9 percent lower than the median price of February 2023, and the average price was $188,810, which is 29.5 percent lower than the average price of February 2023

Houston Real Estate Highlights in February

- Single-family home sales fell 23.0 percent year-over-year, as the market continues its recovery from economic headwinds;

- Compared to pre-pandemic 2019, single-family home sales were up 7.2 percent;

- All housing segments experienced negative sales;

- Days on Market (DOM) for single-family homes rose from 42 to 63 days;

- Total property sales fell 25.3 percent with 6,981 units sold;

- Total dollar volume dropped 27.3 percent to $2.5 billion;

- The single-family average price fell 2.4 percent to $385,103;

- The single-family median price dropped 1.6 percent to $320,000;

- Both pricing decreases were the first since the spring of 2020;

- Single-family home months of inventory registered a 2.6-months supply, up from 1.2 months a year earlier;

- Townhome/condominium sales experienced their ninth straight monthly decline, falling 32.4 percent, with the average price down 7.8 percent to $244,595 and the median price down 3.8 percent to $216,510;

- Compared to pre-pandemic 2019, townhome and condominium sales were up 4.5 percent.