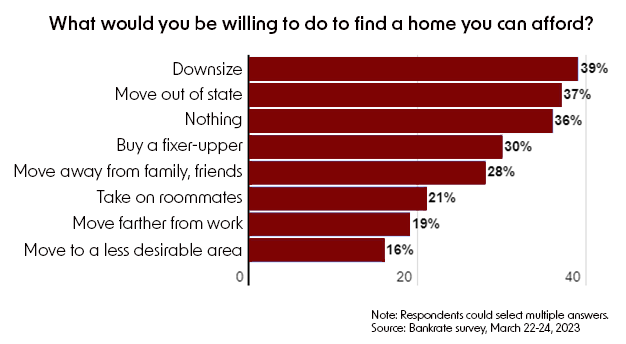

Since 2022, first-time buyers have been experiencing an affordability squeeze, caused by the combination of high home prices and a spike in mortgage rates. Seeking insight into how Americans are coping, Bankrate asked aspiring homeowners what sacrifices they would be willing to make to purchase a home (they could cite multiple answers).

Among homeowners and non-owners, 36 percent wouldn’t be willing to do anything. Of those remaining, 39 percent would downsize their living space, 37 percent would move out of state, 30 percent would buy a fixer-upper and 28 percent would move farther from family and friends. Other respondents mentioned taking on roommates or living with additional family members (21 percent), moving farther away from work (19 percent) and moving to a less-desirable area (16 percent).

Cut Out Luxuries

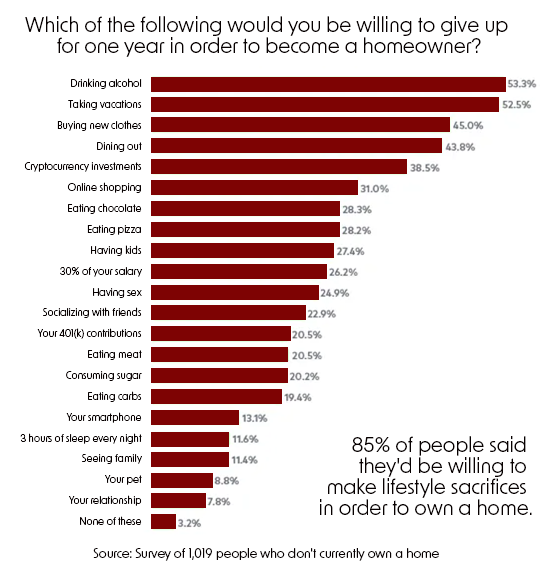

The National Association of Realtors cited a similar survey from Cinch Home Services, a home warranty firm. This survey revealed that some aspiring homebuyers said they would consider forgoing alcohol or vacations for a year to save—while others said they would give up having kids in order to have their dream home. About 60% of recent survey respondents said they would prefer their dream home over 40% who said they’d prefer kids first. There were also some who said they would give up their pet, seeing family, or their relationship for an entire year to save up to own.

Trim Your Wish List

Another report by themortgagereports.com consulted experts who agreed that it is important to be prepared to make concessions in order to buy a home, referring to yet another survey, by PropertyShark. Realtor Ralph DiBugnara said he’s not surprised that younger buyers say they’ll put up with a longer commute.

“When you buy a home, there are always going to be sacrifices you have to make. We are in a market with more limited homes for sale. Therefore, to find what you like you’ll have to compromise some. You can always sell your first home and use the equity built up to purchase a better home later.”

Eliza Theiss, spokesperson for PropertyShark, says almost everybody has to part with some things on their home wish list.

“This is required to avoid heartbreak and overspending,” Theiss says. “Is your dream home worth it if you’ll end up spending every cent on it? And is waiting around for the perfect home to appear worth it while other buyers claim good properties you could have shopped?”

Bruce Ailion, Realtor and real estate attorney, says sacrifices are worth it.

“Historically, housing prices have risen. Like a train pulling away, running to jump on becomes more difficult as the train speeds up. Each year that passes results in higher rents. That makes saving for a down payment harder. So it usually makes sense to buy a home now rather than wait for the perfect home sometime in the future.”

Sacrifices worth making will depend on your personal needs and desires. But if it comes down to saving enough for the down payment, don’t be afraid to tighten the belt. Ailon suggests buyers consider taking a second job, working overtime, and selling off valuables.

“Making compromises is part of a successful purchase. That may mean cutting back on cable. You can make coffee at home versus stopping at Starbucks. You can shop at warehouse stores rather than Whole Foods.”

However, many mortgage programs require little or no down payment, and down payment assistance is available to many who are just starting out. In fact, most who are eligible (and income limits are a lot higher than you probably think) don’t even know about these programs.

The Key Factor You Probably Don’t Want to Compromise on is Location

“A location that’s highly valued by the largest number of people is the key to a profitable investment. The areas to begin making compromises on are size, age, condition and features of the home.” (Ralph DiBugnara)

After all, “improvements can be made to your home any time after your purchase,” adds DiBugnara.

Another Thing You Don’t Want to Surrender: Financial Stability.

“Anything that endangers your current or future finances is not worth it. That means not stretching your budget to the max when you buy a home.” (Eliza Theiss)

Avoid Sacrificing in Areas That Can Prevent Your Home from Appreciating in Value.

“This includes a good school district and affordable taxes. Also, it includes easy access to public transportation and nearness to major highways.” (Ralph DiBugnara)