Due to the one-two punch of higher mortgage rates and higher home prices, home ownership is a concept that's becoming seemingly less attainable with rising mortgage rates and increased competition among buyers. A new income analysis by online real estate brokerage company Redfin (and reported by Culturemap) has revealed just how much money a potential homeowner needs to make in 2023 to afford a "starter home" in Houston.

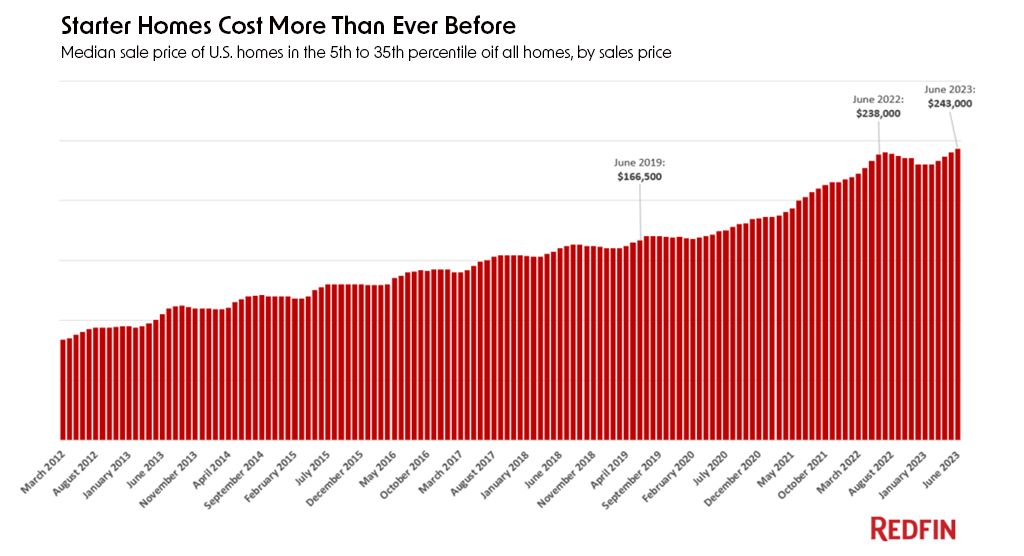

Nationwide, the typical starter home sold for a record $243,000 in June, up 2.1% from a year earlier and up more than 45% from before the pandemic. Average mortgage rates hit 6.7% in June, up from 5.5% the year before and just under 4% before the pandemic. A starter home is a home in the 5th-35th percentile by sales price. Locally, the median price within this range was $217,000 in June 2023.

The Redfin report revealed that Houston homebuyers need 13.9 percent more income than what was required in 2022, rising to $57,513 annually to afford a starter home this year. This is $6,893 below the national average.

These findings further confirm that affordability is one of the biggest struggles for potential buyers in the current real estate market. With Houston's median sale prices for starter homes sitting at $217,000, that brings median mortgage payments to about $1,438 a month, the report said.

Redfin senior economist Sheharyar Bokhari predicted the wealth gap between current and potential owners could become "even more drastic" if current trends continue, describing house-hunting as a "wild goose chase" for homebuyers seeking their first home in the current market.

"The most affordable homes for sale are no longer affordable to people with lower budgets due to the combination of rising prices and rising rates. That’s locking many Americans out of the housing market altogether, preventing them from building equity and ultimately building lasting wealth. People who are already homeowners are sitting pretty, comparatively, because most of them have benefited from home values soaring over the last few years."

Things are not much better elsewhere in the state. Even though the income necessary to afford a San Antonio home has risen by 18.7 percent, that amounts to a required income of $55,657, which is only about $1800 less per year.

A first-time homebuyer would need to make $64,933 to afford a home in Fort Worth, which is 14.4 percent more than in 2022. In Dallas, potential homeowners saw a 10.6 percent increase in income needed to afford a home, making it the city with the second highest income required out of all Texas cities in the report: $72,885.

Potential homeowners in Austin saw a 3.3 percent decrease in income needed to afford a home, but it's still the highest income required out of all Texas cities in the report: $92,057.

Bottom Line

Don't let this discourage you too much, though! Homebuilders have identified an opportunity in the affordability crisis and are building more starter homes and offering promotional mortgage rates. Give us a call to discuss your options!