The December 1, 2023 episode of The New York Times podcast, The Daily, features the counterintuitive claim that now is not the right time to buy real estate. Forza is here to tell you why that is wrong…

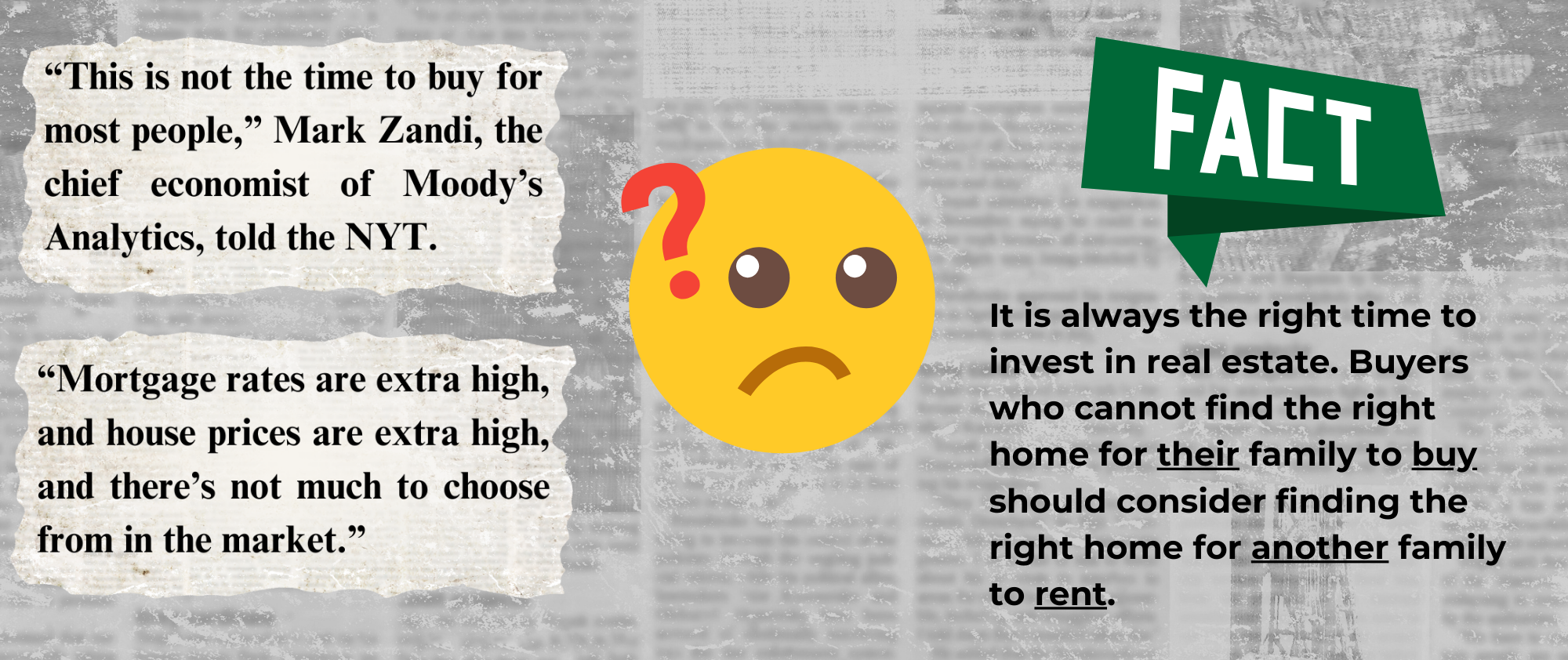

NYT: “This is not the time to buy for most people,” Mark Zandi, the chief economist of Moody’s Analytics, told me. “Mortgage rates are extra high, and house prices are extra high, and there’s not much to choose from in the market.” Zandi added: “If you find the perfect place, then by all means buy it. But most people are not going to find it.”

Fact Check: it is always the right time to invest in real estate. See our blog from 02/9/2022. Buyers who cannot find the right home for their family to buy would do well to consider finding the right home for another family to rent. With your own location and square footage needs removed from the equation, the number of eligible properties increases exponentially. From here it’s just math: if you can find a property that will rent for more per month than you are paying for your own rental, you can use the rental payments to pay your own rent and then save any excess for your next real estate purchase.

Full disclosure, down payments on rental properties can be up to 17% higher than on owner-occupied properties. Buyers acquiring a “compromise” property for rental purposes may need to occupy the property for two years: until their mortgage pre-payment penalty has expired, and the value has increased to such an extent that they can then refinance into a loan that does not require owner occupancy. With a sufficient increase in value, a “cash-out” refinance may further allow the owner to pull enough equity out of the rental property to finance their next home purchase.

Furthermore, there is no “perfect place,” Mr. Zandi. See our blog from 08/30/2023. Every real estate purchase involves compromise—whether it's accepting fewer square feet in exchange for a good location, accepting a longer commute in exchange for an extra bedroom, or accepting a larger monthly payment in exchange for both—there is no perfect home.

NYT: Renting still brings a stigma. People equate it with throwing away money each month rather than investing in their future. The real estate industry promotes this idea because it makes far more money from a home sale than a rental.

Fact Check: this is an apples-to-oranges comparison. While the final check a realtor receives from a rental will be smaller than from a sale, the number of hours invested are usually far less. If the industry was discouraging rentals, there would not be thousands of agents focusing exclusively on rentals.

NYT: (Broker commissions are significantly higher in the U.S. than in many other countries, as Veronica Dagher of The Wall Street Journal has reported. The average sales commission here is 5.5 percent, compared with 4.5 percent in Germany, 2.5 percent in Australia and 1.3 percent in Britain.)

Fact Check: Most realtors earn 3% on most transactions, and 2% is not uncommon. The 6% fee often specified in the listing agreement is split between the buyer’s agent and the seller’s agent.

NYT: Higher rates make monthly mortgage payments for new homes more expensive, which reduces demand and, in turn, should cause home prices to fall. But prices haven’t fallen. Why not? Many homeowners feel an emotional attachment to their home value. They come up with a price they think they deserve and are unwilling to sell for less. Rather than cutting the price to make a sale, they pull the house off the market.

Fact Check: home prices are set via market analysis. Previous sales of comparable houses in the same neighborhood are analyzed to determine the appropriate asking price for a listing.

NYT: That’s partly why home sales have plummeted recently, but prices have hardly budged.

Fact Check: home sales have plummeted due to low inventory, which is strongly tied to interest rates. Homeowners who purchased with low rates-- who might otherwise have traded up-- are holding on to their homes because it does not make sense to trade a monthly payment as low as $1000 per month for a monthly payment of double or triple that amount—often for less square footage

NYT: The rent-versus-buy decision always involves trade-offs. Buying allows people to invest in an asset that they can later sell instead of paying a landlord each month. […] On the flip side, buyers effectively pay tens of thousands of dollars to real estate agents. (Technically, the seller pays the agents — using the money the buyer paid — but the broker’s fee inflates the cost for a buyer.)

Fact Check: As mentioned, home prices are set via market analysis of previous sales of comparable houses in the same neighborhood. A “for sale by owner” home sitting next to an identical agent-listed home will have an near-identical price. A seller seeking to maximize their ROI is not going to leave 6% on the table because they don’t have to pay any agents.

NYT: Buyers must also pay to fix leaky roofs and broken plumbing.

Fact Check: any buyer can have an option period written into the sales contract—and ALL buyers SHOULD. During this period, the buyer obtains a home inspection and uses that report to negotiate repairs that the seller must then have completed before closing. Sellers who don’t agree to carry out repairs are asked to reduce the price. The contract can be terminated if the seller refuses to do either of these.

NYT: [Buyers] must tie up money in a down payment, instead of being able to invest it elsewhere. They must bear the risk that house prices will fall — and prices really can fall.

Fact Check: Home prices are likely to decelerate, but they are not likely to fall. To “decelerate” means the speed at which prices change will slow, but the direction of the change is not likely to reverse. “Deceleration” can translate into a relative decrease for an individual buyer, should their income increase, but income growth is contingent on factors unique to that buyer’s personal situation. See our blog from 04/13/2022

NYT: [A]fter the housing bubble of the early 2000s, prices didn’t return to their previous peak for more than a decade.

Fact Check: the 2008 housing bubble was caused by lending practices that caused a high rate of foreclosures. Buyers today are more qualified and less likely to default on their loans because those lending practices are no longer permitted. See our blog from 02/23/2022

NYT: If you think you will move in several years, renting often wastes less money than buying.

Fact check: money spent on real estate is invested and can grow and yield returns. Money spent on rent does not grow and can never yield a return. Barring another housing bubble, which tightened lending practices have largely ruled out, buyers are not likely to lose money.

NYT: The current housing market has made renting even more attractive. Only if you find an affordable house where you’re confident you will stay for a decade or longer does buying make sense in many places.

Fact check: A decade? The term “starter home” exists for a reason. The single most accessible path to wealth is through real estate, the single most accessible path to real estate wealth is via ownership of rental property, and the single most accessible path to ownership of rental property is by renting out your “starter home” when it comes time for you to upgrade. See our blog from 08/15/2018

Bottom Line:

Prices are up and inventory is down, and the result has been that large swathes of the population feel “locked out” of homeownership. This is causing young people to perceive the economy as “bad.” This perception is dangerous to many entrenched interests, so there is motivation for pundits to try to “spin” these conditions in such a way that paints renting as a choice. While it is true that home shoppers may not be able to find the perfect residence for their family, this does not mean that they cannot take advantage of the single most accessible road to wealth in America. By choosing to ignore opportunities in the rental market and focusing only on properties intended to be owner-occupied, the Times is encouraging readers to “sit this one out”—further entrenching a status quo and a wealth disparity that disproportionately impacts younger and minority populations.