The NATIONAL ASSOCIATION OF REALTORS® Profile of Home Buyers and Sellers was released November 13, 2023. This Profile is an annual survey of recent home buyers and sellers who recently completed a transaction between July 2022 and June 2023. While each year provides new opportunities and challenges for buyers and sellers, this year marked the end of the COVID-19 pandemic induced housing boom. The 2023 Profile shows some moderation in trends that moved towards all time highs and lows in the data. Some of the reversion in the data is likely due to the increase in mortgage interest rates, which moved between six and over seven percent in the period.

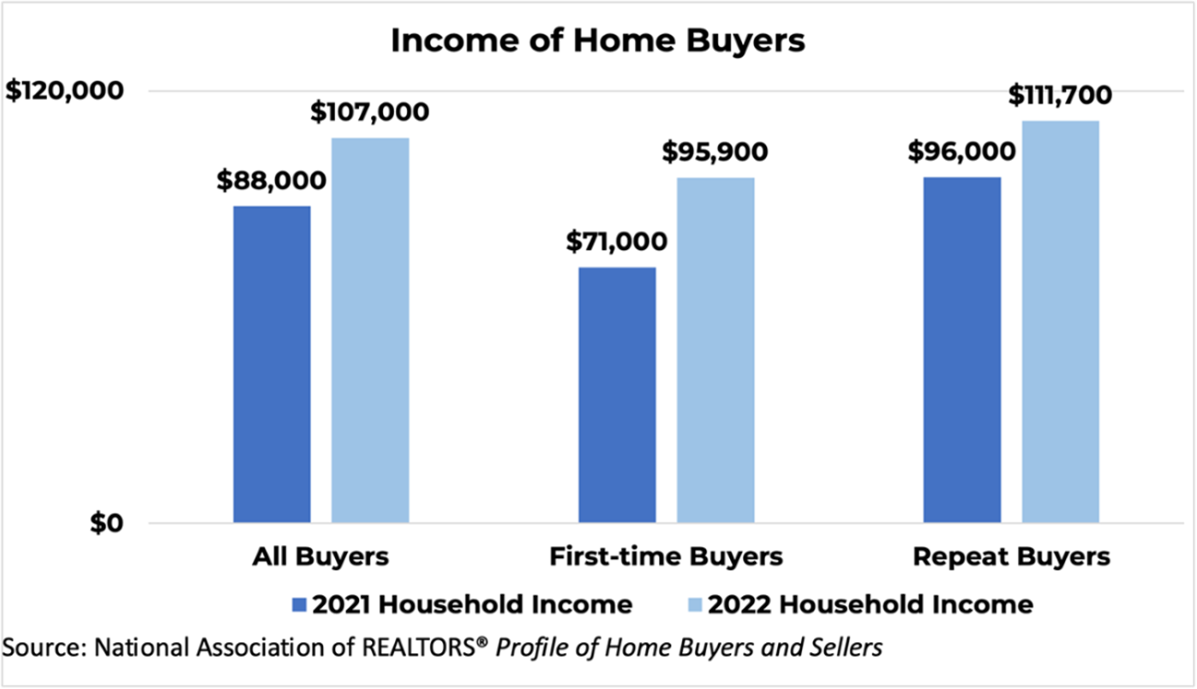

Data in this year’s report continues to show buyers encountering a housing market with limited housing inventory and affordability constraints. Other trends are likely a result of return-to-office demands. For home buyers to compete in this year’s housing market, they had to have a household income to support their purchase. The typical home buyer had a household income of $107,000, up from $88,000 the year before. With the rise in housing equity, due to the rise in home prices, there is an elevated share of buyers who are not financing their home purchase. Twenty percent of home buyers paid cash for their home, without financing it.

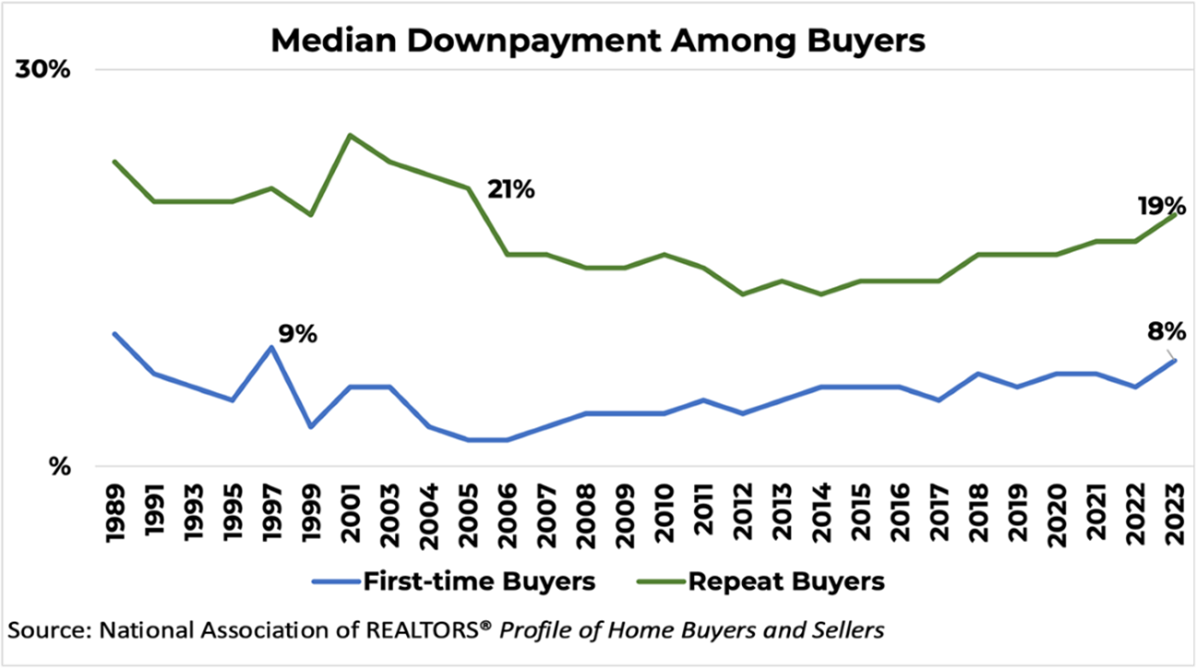

In the 2022 report, 22 percent of buyers paid with cash for their home, but in 2021, this share was only 13 percent. Down payments also grew this year for both first-time and repeat buyers—first-time buyers likely as they may need to have a stronger offer among all-cash buyers and among repeat buyers as they have increased housing equity. The typical down payment for first-time buyers was eight percent, which is the highest share since 1997 when the typical down payment was 9% for first-time buyers. The typical down payment for repeat buyers was 19%, which is the highest share since 2005 when the typical down payment was 21%.

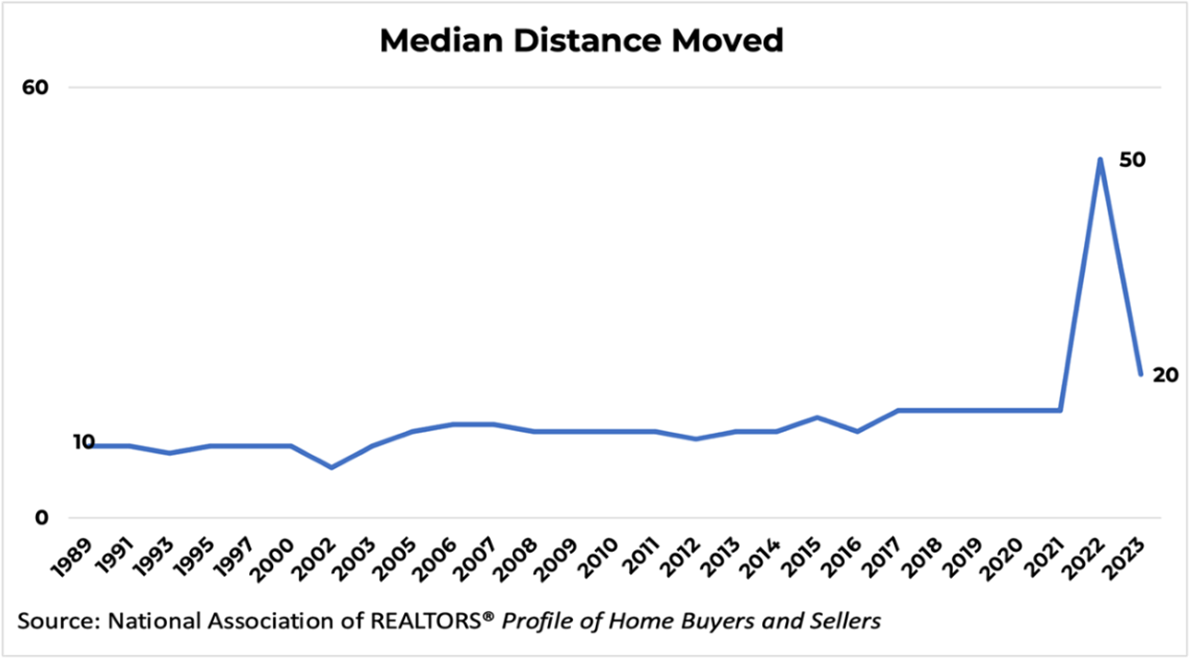

Buyers were driven into the market with the desire to own a home of one’s own, to be near friends and family and the need for a larger home. Distance moved from the last home decreased from 50 miles to 20 miles, but remains elevated from previous years where 15 miles was typical. Similarly, while suburbs have boomeranged back (47 percent in 2023 report from 39 percent in the 2022 report), they remain under the norm seen in 2017 to 2021 when the share was over 50 percent of buyers. At the same time, small towns and rural areas remain more popular than they were over the same time period.

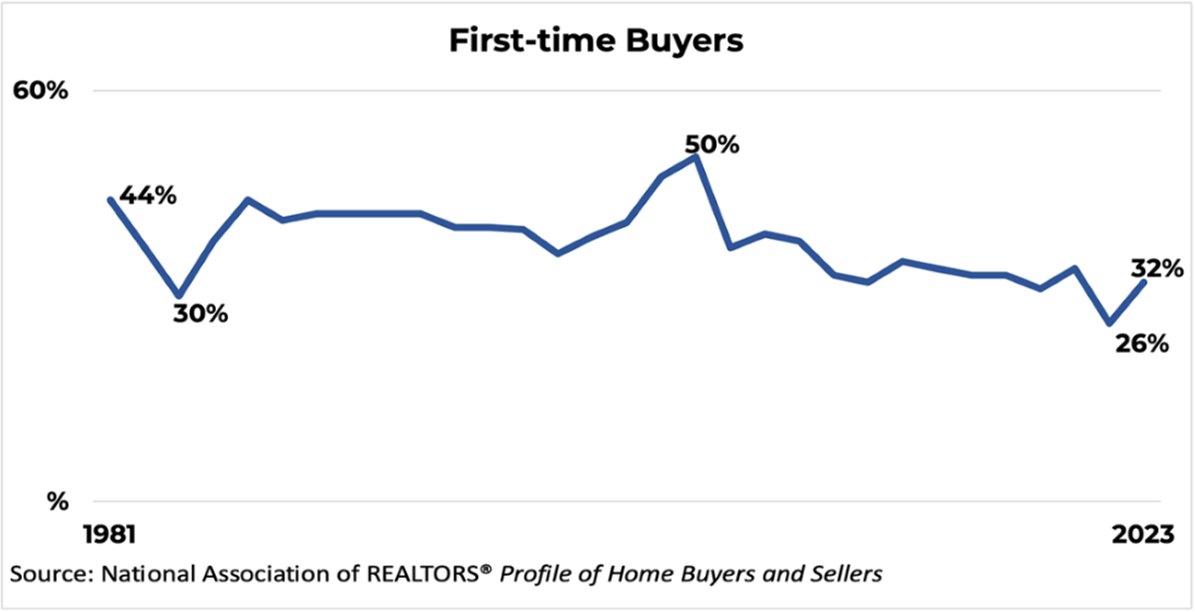

As competition in the market receded due to higher borrowing costs, first-time buyers had an opportunity to enter the market. Their share grew from a historic low of 26 percent to 32 percent. While this is a rise, this is still the fourth lowest share seen in more than four decades of data collection. The age of both first-time buyers and repeat buyers has declined one year from historic highs seen last year to a median of 35 and 58, respectively. These are the second highest ages seen in the data set.

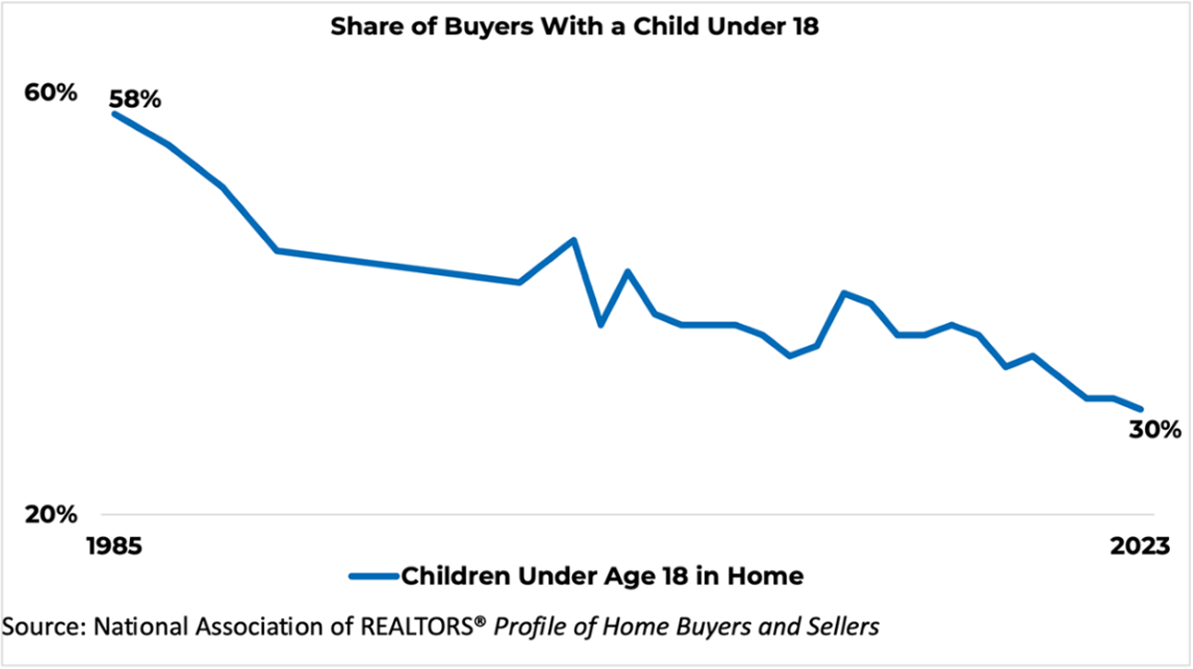

This year’s report also saw a growing number of minority home buyers. Overall 81 percent of buyers were White/Caucasian, down from 88 percent last year. Ten percent of buyers were born outside the U.S., up from eight percent last year. Six percent of buyers spoke a primary language other than English, up from five percent last year. Household composition of buyers continues to shift. Fifty-nine percent of recent buyers were married couples. This is the lowest share of married couples since 2010, while single women and men rose. Multi-generational living continues to remain popular with the 14 percent of all buyers purchasing a home that will house different generations for elder care, young adults moving back, and for cost savings. The share of buyers with children under the age of eighteen dropped to the lowest level seen at 30 percent of all buyers.

The number of weeks a buyer searched for a home remained steady at 10 weeks from last year. Many buyers took advantage of virtual tours and virtual listings and used those in their search process, a transformation that happened in the pandemic and has continued among buyers’ activity. Due to limited inventory, it is not a surprise, buyers continue to report the most challenging task for them in the home buying process was just finding the right home to purchase. However, overall 92 percent of home buyers are satisfied with the buying process.

Sellers continue to report the top reasons to sell were the desire to be close to friends and family and because their home was too small. Tenure has also maintained the high of 10 years, which has become common out of the Great Recession. Among sellers, 39 percent purchased a larger home and 28 purchased the same size home. This year, sellers sold their property typically at 100 percent of their asking price, and one-third received more than asking price for their home.

Buyers needed the help of a real estate professional to help them find the right home for them and negotiate terms of sale. Eighty-nine percent of buyers used an agent to help them purchase a home, an increase from 86 percent the year prior. The top item buyers want from their agent is to help them find the right home to purchase. Buyers also found their agent helped them understand the buying process, pointed out unnoticed features and faults in the property, provided a better list of service providers and negotiated better sales contract terms.

Sellers, as well, turned to professionals to price their home competitively, help market the home to potential buyers, and sell within a specific timeframe. Eighty-nine percent of sellers used an agent to sell their home, an increase from 87 percent the year prior. While the survey asked about iBuyer of respondents, less than one percent of sellers used these online only programs. Seven percent of sellers sold via For-Sale-By-Owner (FSBO), a decrease from 10 percent last year and matching a series low seen in 2021. Over half of FSBO sellers knew the buyer of their home.

The information provided supplies understanding, from the consumer level, of the trends that are transpiring. This survey covers information on demographics, housing characteristics, and the experience of consumers in the housing market, as well as for those who are not yet able to enter the market. Buyers and sellers also provide valuable information on the role that real estate professionals play in home sales transactions.

For homeowners considering selling, or for buyers in the market, this data can be valuable both when staging, photographing, and marketing a home, or when making offers. Knowing what motivates or constrains behavior on either side of the transaction can be a significant asset. Read the full report here: https://www.nar.realtor/sites/default/files/documents/2023-profile-of-home-buyers-and-sellers-highlights-11-13-2023.pdf