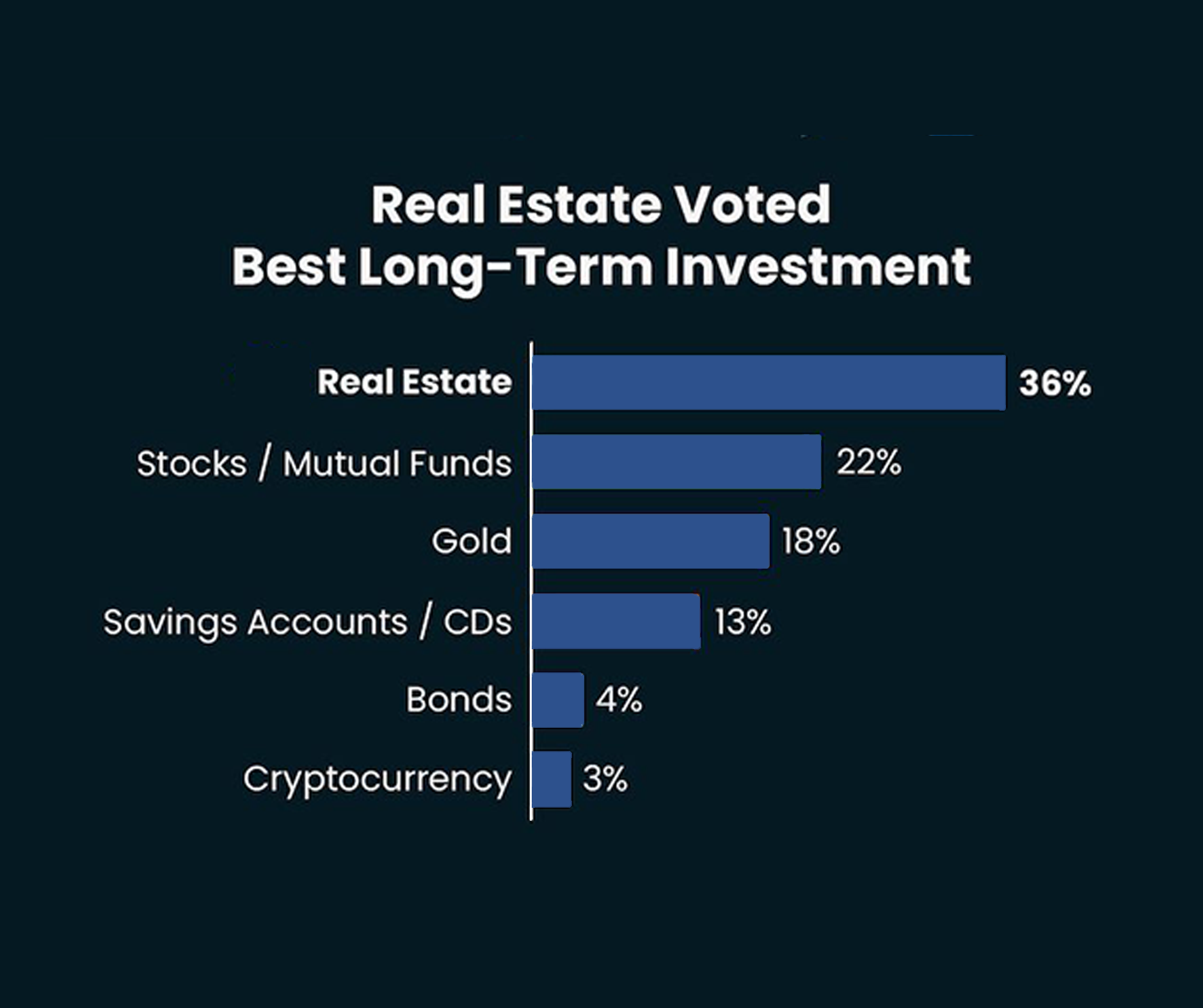

According to a recent poll from Gallup, real estate has been voted the best long-term investment for twelve straight years.

That’s because a home is so much more just than a roof over your head. It’s also an asset that typically grows in value over time.

Americans continue to rank real estate as the best investment for the long term among six options. Thirty-six percent choose real estate, followed by stocks or mutual funds (22%), gold (18%), and savings accounts or CDs (13%). Relatively few Americans believe bonds (4%) or cryptocurrency (3%) are the best long-term investments.

The percentage of adults choosing real estate is similar to a year ago, but more identify stocks and fewer name gold as the best investment this year. Stocks were last higher than now in 2021, when 26% chose them, while gold has returned to more typical levels after an increase last year.

The latest results are based on Gallup’s annual Economy and Personal Finance survey, conducted April 1-22. Since 2011, Gallup has asked Americans to choose among real estate, stocks, gold, savings accounts and bonds as the best investment. Cryptocurrency was added as an option in 2022.

Real estate has topped the list each year since 2014, with between 30% and 45% (in 2022) selecting it. In 2013, real estate essentially tied for first with gold and stocks; it trailed gold in 2011 and 2012.

While today’s mortgage rates might seem a bit intimidating, here are two solid reasons why, if you’re ready and able, it could still be a smart move to get your own place.

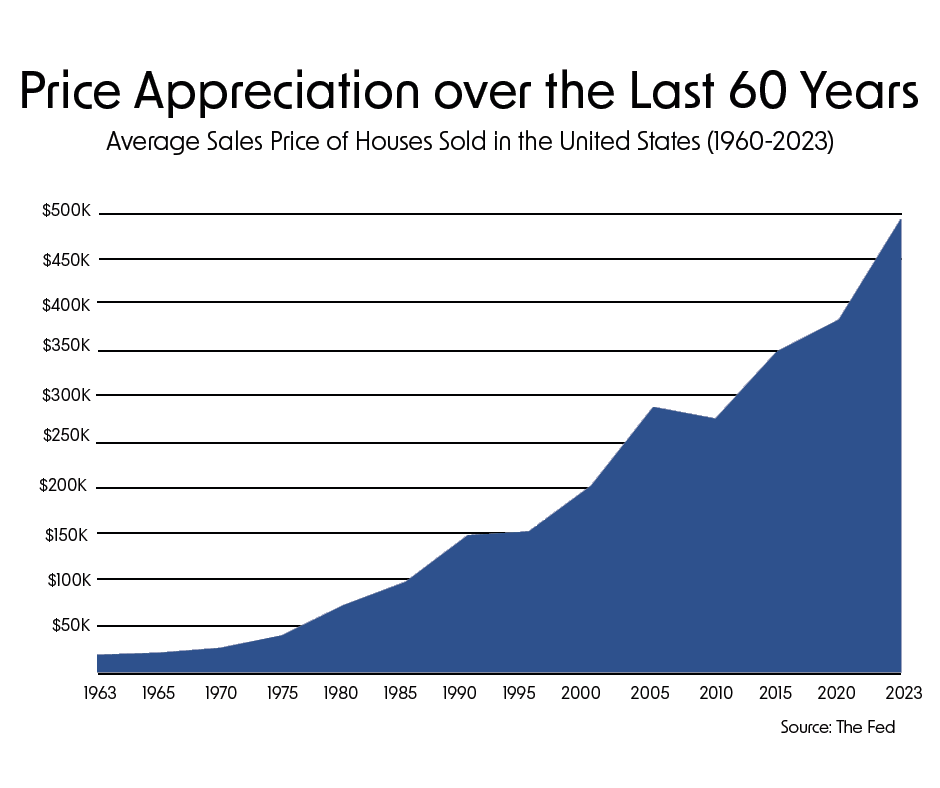

There’s been some confusion over the past year or so about which way home prices are headed. Make no mistake, nationally they’re still going up. In fact, over the long-term, home prices almost always go up (see graph below):

Using data from the Federal Reserve (the Fed), you can see the overall trend is home prices have climbed steadily for the past 60 years. There was an exception during the 2008 housing crash when prices didn’t follow the normal pattern, but generally, home values kept rising.

This is a big reason why buying a home can be better than renting. As prices go up and you pay down your mortgage, you build equity. Over time, this growing equity can really increase your net worth.

Over time, equity can turn your mortgage debt into a sizeable asset. You can use it to get a line of credit, a home equity loan, or a refinance. Alternatively, if you’re considering selling your house, that equity you create can be used toward purchasing your next home.

When you initially get a mortgage, most of the equity in your home belongs to the bank. That could be 80% to 95%, depending on how much down payment you made. Every time you make a mortgage payment, the home equity portion (the amount you own outright) increases—minus any outstanding mortgage or other liens.

“Simply put, equity is the difference between the current market value of the property you own and the amount still owed on the mortgage,” says Adie Kriegstein, a real estate agent and founder of the NYC Experience Team at Compass.

Every mortgage payment you make increases your equity. However, your equity can decrease if you decide to use your equity for a line of credit or home equity loan.

Building your equity egg takes time. And depending on the market conditions, your equity can rise sharply or take a nosedive. Today, many homeowners are sitting on record-high amounts of equity because of the decade-long boom of low interest rates, up until 2022.

“As home prices increase, and so long as your debt remains constant, the equity value in your home will increase,” says Jill Fopiano, CEO of O’Brien Wealth Partners.

When you sell your home, the equity you built can be used to pay off the remaining mortgage balance and other debts, potentially leaving you with a profit.

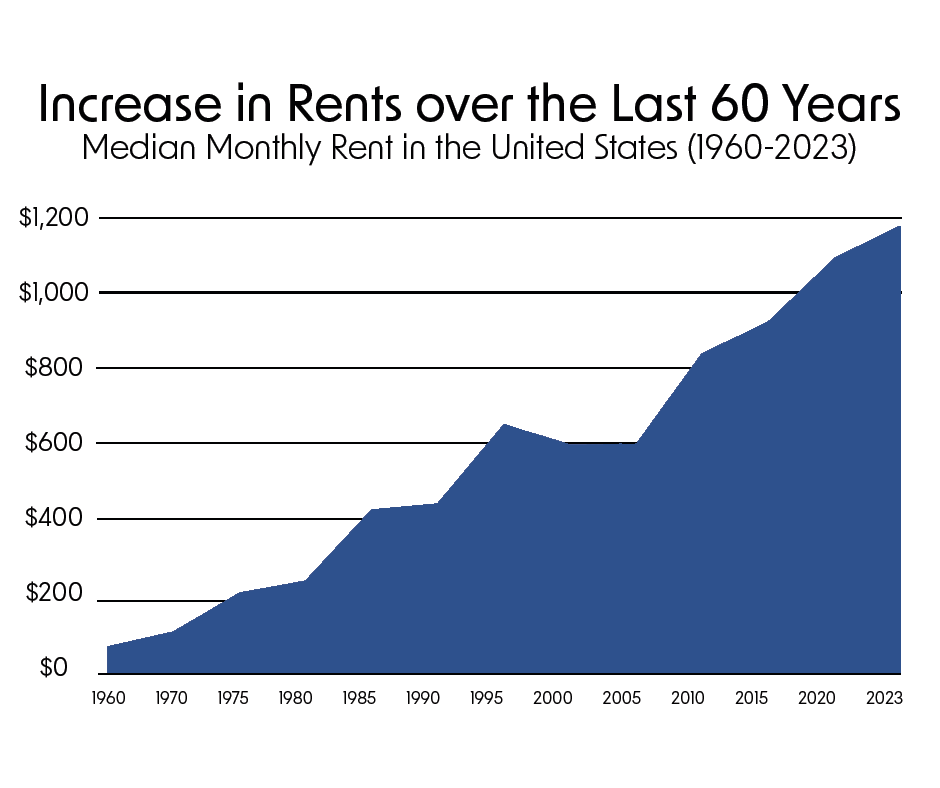

Another reason you may want to think about buying a home instead of renting – rent just keeps going up over the years. Sure, it might be cheaper to rent right now in some areas, but every time you renew your lease or sign a new one, you’re likely to feel the squeeze of your rent getting higher. According to data from iProperty Management, rent has been going up pretty consistently for the last 60 years, too (see graph below):

So how do you escape the cycle of rising rents? Buying a home with a fixed-rate mortgage helps you stabilize your housing costs and say goodbye to those annoying rent increases. That kind of stability is a big deal.

Your housing payments are like an investment, and you’ve got a decision to make. Do you want to invest in yourself or keep paying your landlord?

When you own your home, you’re investing in your own future. And even when renting is cheaper, that money you pay every month is gone for good.

If you’ve been debating if it makes more sense to rent or buy, connect with Forza to talk about why homeownership can be a better bet in the long run.