(HAR Newsroom, February 12, 2025) Houston's resilient housing market weathered a rare winter storm in January. While the record snowfall caused temporary disruptions, the market quickly rebounded and maintained a healthy balance between supply and demand.

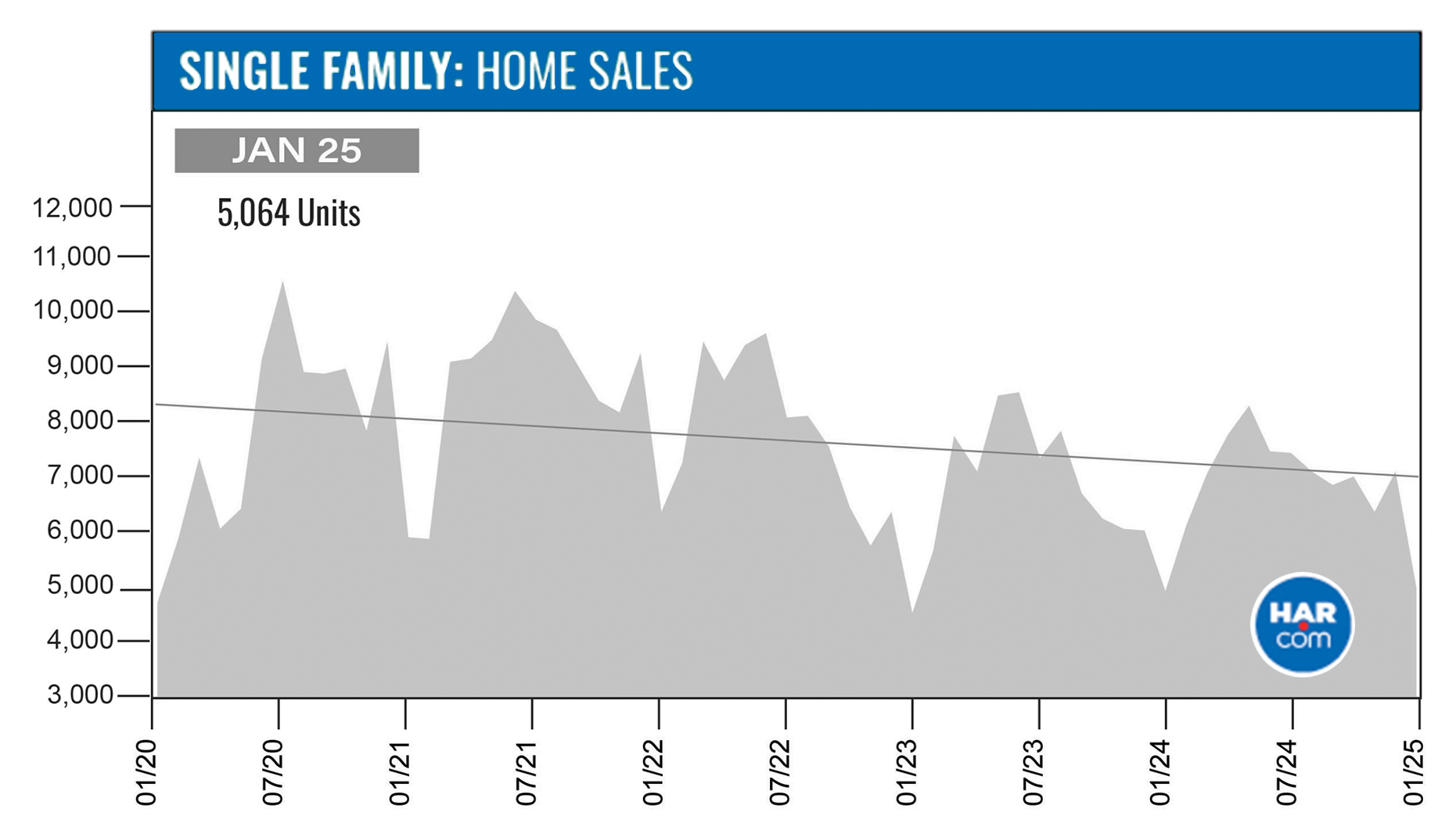

According to the Houston Association of Realtors’ (HAR’s) January 2025 Housing Market Update, single-family home sales across the Greater Houston area rose 1.2 percent, with 5,064 units sold compared to 5,002 in January 2024. This marks the fifth consecutive month of sales growth, a trend last observed in the first half of 2021.

The high end of the market continued to experience a wave of buyer interest. The luxury segment ($1 million+) recorded a 20.7 percent increase in sales compared to last January. Next was the $500,000 to $999,999 segment which saw an 8.1 percent gain. Homes priced between $250,000 and $499,999 made up the most sales in January, but sales were 1.6 percent below last year’s level. The segment comprised of homes priced $149,99 and below also experienced a slowdown in sales activity.

“We're seeing a healthy balance in the Houston housing market as we head into the traditionally busy spring and summer months,” said HAR Chair Shae Cottar with LPT Realty. “Inventory is in a good place to handle the expected uptick in buyer demand. Interest rates will remain a factor, but the market fundamentals are strong.”

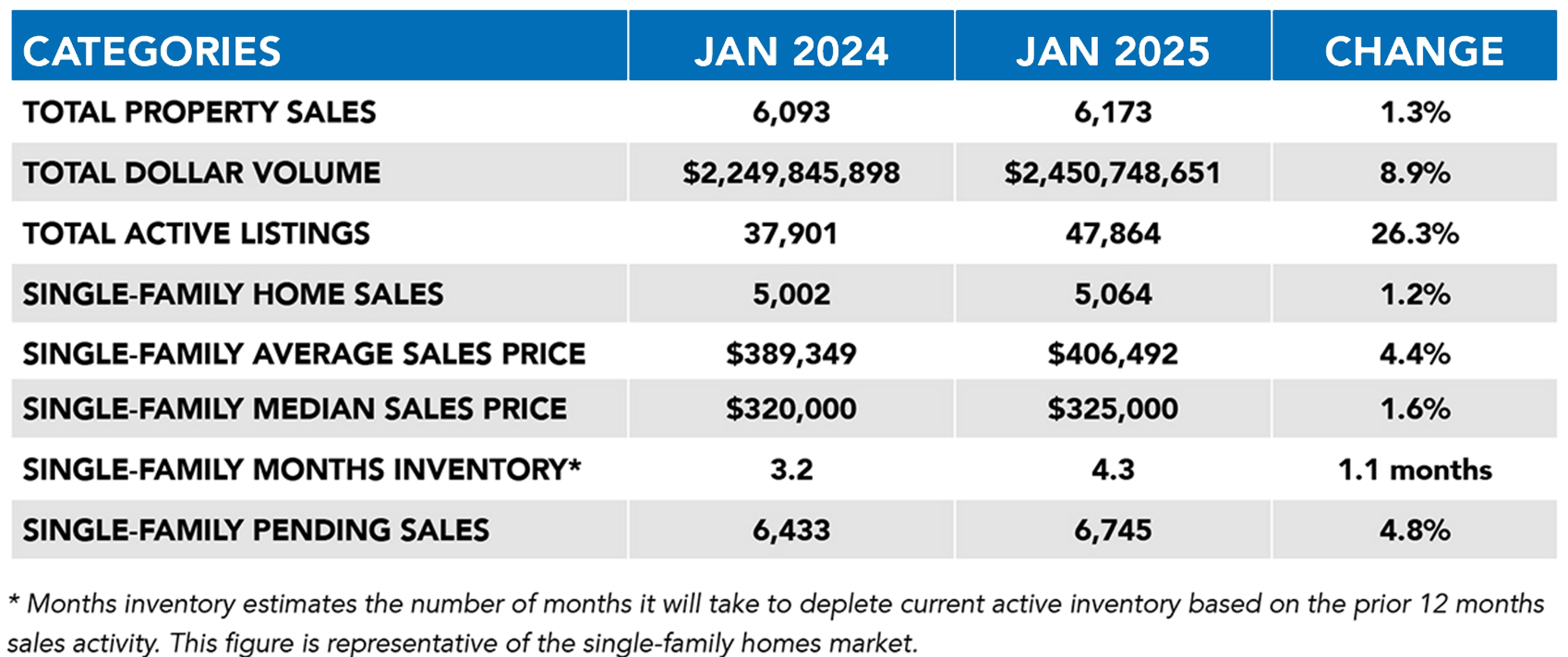

January Monthly Market Comparison

The Houston housing market’s positive momentum continued in January, with total property sales increasing 1.3 percent year-over-year. Total dollar volume rose 8.9 percent to $2.5 billion. Active listings, or the total number of available properties, were 26.3 percent above the 2024 level.

Single-Family Homes Update

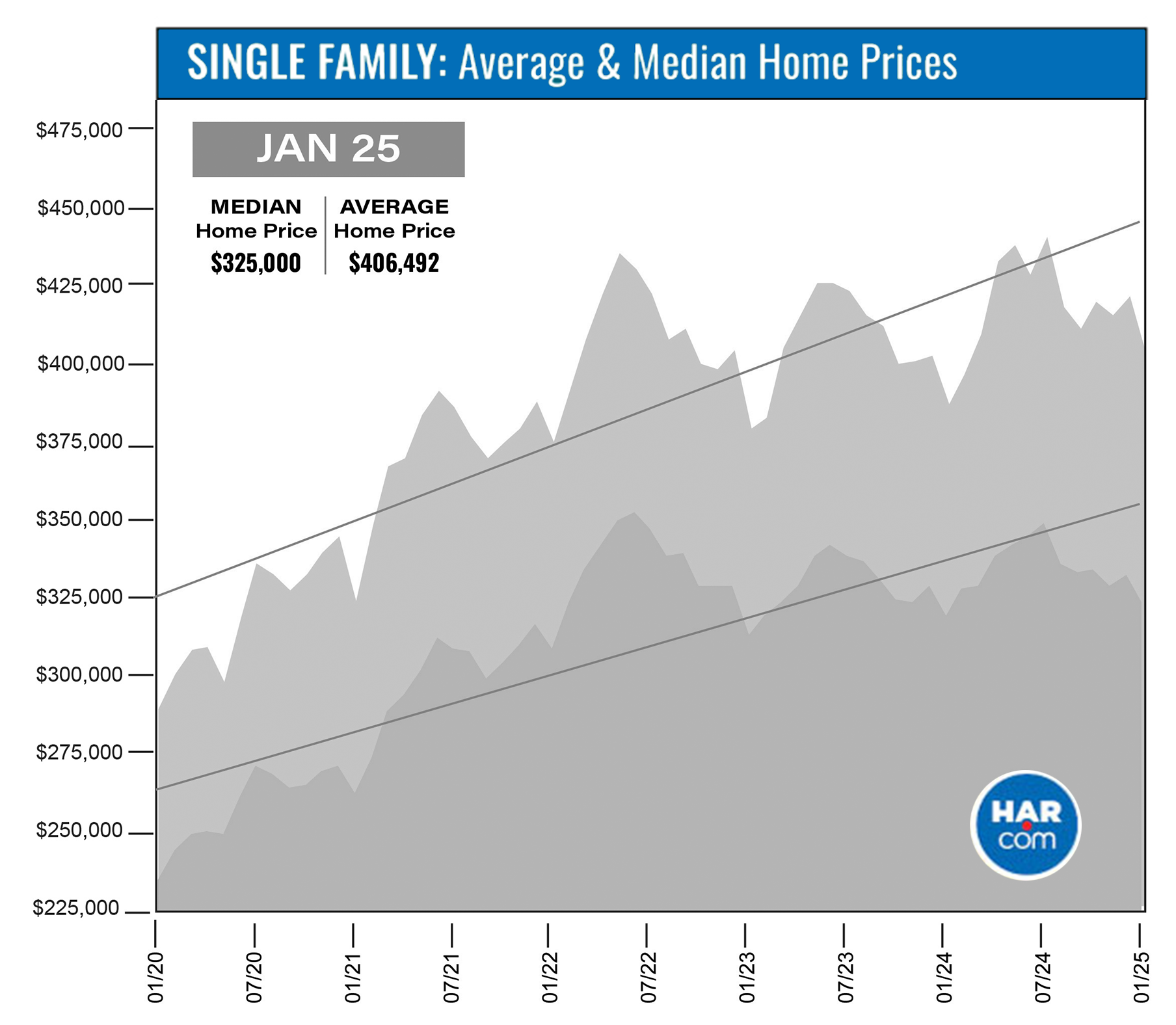

January marked the fifth month in a row where single-family home sales were in positive territory with sales increasing 1.2 percent year-over-year. A total of 5,064 units were sold across the Greater Houston area compared to 5,002 during the same time last year. The average price rose 4.4 percent to $406,492 while the median price edged up by 1.6 percent to $325,000. The price per square foot increased to $174 from $169 in January 2024.

Active listings were 33.3 percent above the volume of 2024 and have remained around 30,000 units for the last eight months, demonstrating a balance between supply and demand.

Days on Market, or the actual time it took to sell a home, increased from 59 to 61. Months of inventory expanded to a 4.3-months supply from 3.2-months the prior year. The current national supply stands at 3.3 months, as reported by the National Association of Realtors (NAR).

Broken out by housing segment, November sales performed as follows:

- $1 - $99,999: decreased 4.1 percent

- $100,000 - $149,999: decreased 10.4 percent

- $150,000 - $249,999: increased 3.0 percent

- $250,000 - $499,999: decreased 1.6 percent

- $500,000 - $999,999: increased 8.1 percent

- $1M and above: increased 20.7 percent

HAR also breaks out sales figures for existing single-family homes. In January, existing home sales totaled 3,493, up 2.5 percent compared to the same time in 2024. The average price rose 7.6 percent to $415,004, and the median sales price increased 4.5 percent to $323,000.

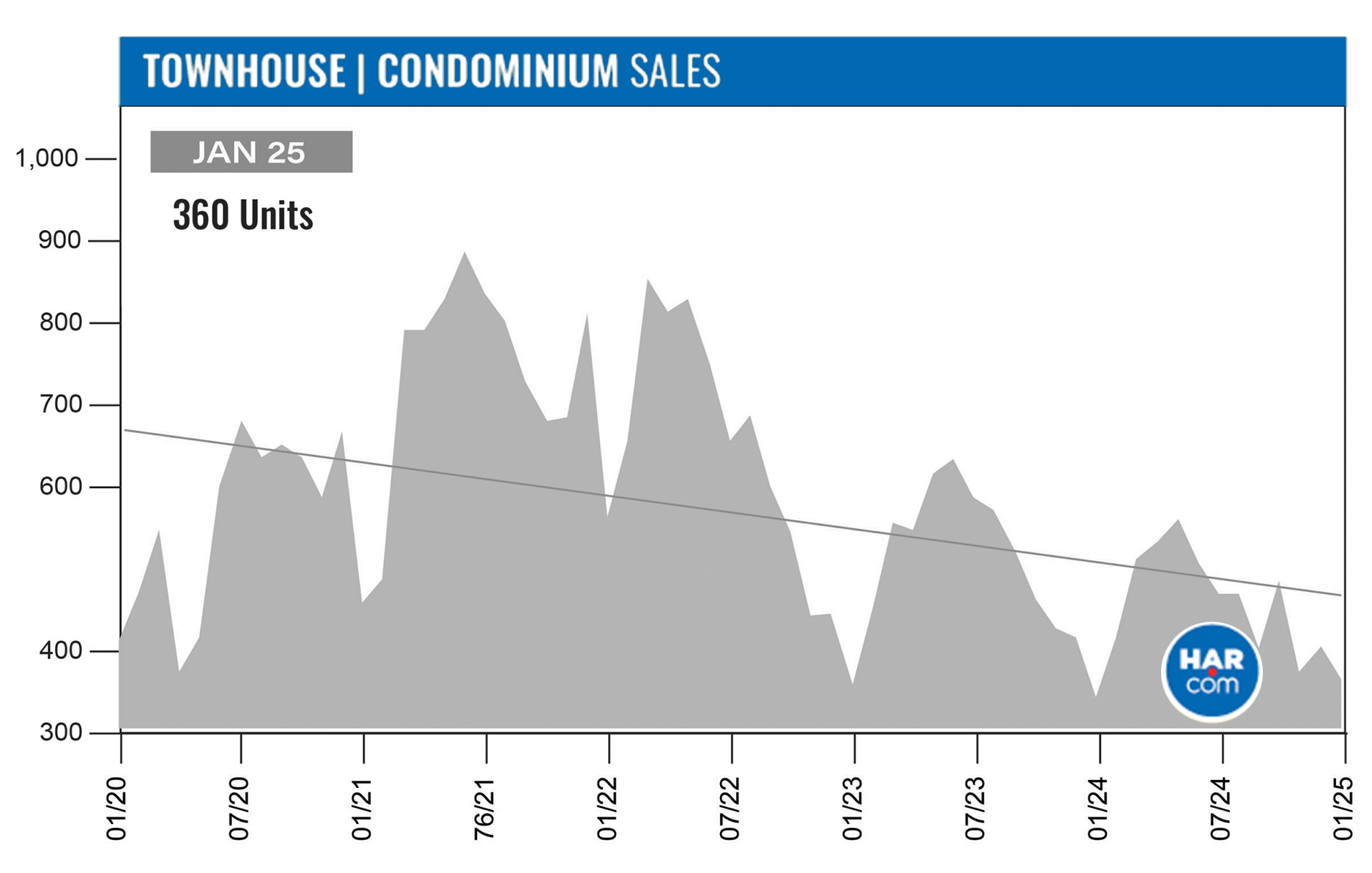

Townhouse/Condominium Update

Townhome and condominium sales rose 6.8 percent in January to 360 units. This marked only the second time sales have been in positive territory since June 2022. The average price was statistically flat at $248,241, and the median price declined 4.1 percent to $211,000.

The inventory of townhomes and condominiums expanded from a 3.6-months supply last January to 5.6-months.

Houston Real Estate Highlights in January

- Single-family home sales increased 1.2 percent year-over-year;

- Days on Market (DOM) for single-family homes went from 59 to 61 days;

- Total property sales were up 1.3 percent with 6,173 units sold;

- Total dollar volume rose 8.9 percent to $2.5 billion;

- The single-family median price was up 1.6 percent to $325,000;

- The single-family average price climbed 4.4 percent to $406,492;

- Single-family home months of inventory registered a 4.3-months supply, up from 3.2 months last January.

- Townhome/condominium sales increased 6.8 percent year-over-year. The median price declined 4.1 percent to $211,000, and the average price was statistically unchanged at $248,241.